Read the full Autumn Investment update

Understanding the Changes: What This Means for You

The Chancellor’s Autumn Budget (26 November 2025) set out a wide range of tax and financial measures aimed at stabilising public finances and shaping future spending. While many headlines focused on tax rises and spending commitments, the impact will vary significantly depending on your personal circumstances – income level, savings and investments, property ownership, pension arrangements and where you live (many of these won’t apply in Scotland, where there will be a separate budget in January). Key Changes Affecting Individuals, Savers & Families

Income Tax & National Insurance (NI)

The UK Government has frozen income-tax thresholds and NI thresholds until April 2031. This means

more of your income becomes taxable over time as wages rise – sometimes called a “stealth tax”.

Scottish clients: Scotland sets its own income-tax bands and rates. The UK freeze applies only

to NI and savings/dividend rates. Scottish earnings income is taxed differently (see Section 7).

Savings, Dividends & Investment Income

- Dividend tax rates will increase by 2 percentage points from April 2026.

- Savings interest tax rates will rise by 2 percentage points from April 2027.

- Clients holding significant savings or investment income outside tax wrappers (ISAs, pensions, bonds) may see higher tax bills.

Changes to ISAs

- The overall ISA allowance remains £20,000.

- From April 2027, those aged under 65 will be limited to £12,000 in a Cash ISA.

- Over-65s can still use the full £20,000 in cash.

- This pushes more savers toward Stocks & Shares ISAs for full allowance use.

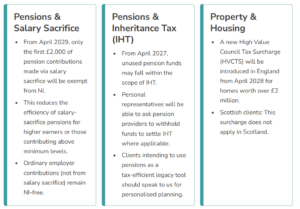

Pensions, Property & Family Changes

Electric Vehicles & Motoring

From 2028, a mileage-based charge will apply:

- 3p per mile for electric vehicles

- 1.5p per mile for plug-in hybrids

Family Finances

The long-criticised two-child benefit cap will be removed from April 2026. This may provide meaningful

additional support to larger families.

Key Points for Business Owners

Dividend vs Salary

With dividend tax rising and corporation tax already increased, some business owners may find the

salary vs dividend balance has shifted. The freeze on tax thresholds until 2031 increases the

importance of planned remuneration strategies.

Salary Sacrifice for Directors/Employees

The £2,000 NI-free cap from 2029 will reduce the efficiency of large salary-sacrifice pension

arrangements. Employers may wish to review benefit structures ahead of time.

Capital Gains Tax (CGT) & Employee Ownership Trusts

CGT relief for disposals to Employee Ownership Trusts has been reduced from 100% to 50%, effective

immediately (from November 2025).

Inheritance Tax (IHT)

Nil Rate Band

The IHT nil-rate band (£325,000) and residence nil-rate band (£175,000) are frozen until April 2031.

Freezes and rising asset values are expected to bring more estates into the IHT net.

Agricultural & Business Relief

From April 2026, the first £1 million of qualifying agricultural or business property receives 100% relief;

above this, relief drops to 50%. The £1m relief is now transferable between spouses, even if the first death

occurred before April 2026.

State Pension, Scotland & What This Means for You

State Pension & Welfare Measures

The State Pension will rise by 4.8% in April 2026. For many, the State Pension will be very close to the

personal allowance – meaning other income may become taxable sooner. Restrictions on voluntary NI

contributions from overseas will tighten.

What Does Not Apply in Scotland?

- High Value Council Tax Surcharge (properties over £2m)

- Income-tax thresholds and bands for earnings

- Some property-income tax changes

Scottish income tax continues to have its own system – including starter, basic, intermediate, higher,

advanced and top rates – which may diverge further. Updates will follow once the Scottish Budget

confirms rates for the coming tax year.

What This Means for You – Our Guidance

For Employees & Professionals

- Expect ongoing “fiscal drag” as thresholds stay frozen.

- Review pension-contribution strategy ahead of the 2029 salary-sacrifice cap.

For Savers & Investors

- Maximise ISAs and pensions to shelter investment income from rising rates.

- Review large cash holdings, especially those outside ISAs.

For Business Owners

- Dividend-tax rises increase the importance of structured remuneration.

- Consider whether current profit-extraction strategies remain tax efficient.

This Budget contains several multi-year changes that may affect long-term planning. Our role is to help

you navigate these changes confidently. We’re here to discuss how these changes affect your specific

circumstances and help you plan accordingly.